Property Tax Mill Rate Westchester . It utilizes a specific calculation: 2024 special district tax rates. we offer you access to historical property tax rates, equalization rates, residential assessment ratios,. the mill rate is simply a tax rate that is used to assess the property tax within a jurisdiction. Looking for more property tax statistics in your area? the average property tax bill in westchester in 2017 was just over $17,000, at an effective tax rate (a percentage of assessed. below are property tax rates since 2002. real estate tax rates in new york are given in mills, or millage rates. westchester county stats for property taxes. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. Since these can be a little. A mill is equal to $1 of tax for every $1,000 in property value.

from dxozainez.blob.core.windows.net

real estate tax rates in new york are given in mills, or millage rates. the average property tax bill in westchester in 2017 was just over $17,000, at an effective tax rate (a percentage of assessed. A mill is equal to $1 of tax for every $1,000 in property value. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. Since these can be a little. Looking for more property tax statistics in your area? 2024 special district tax rates. westchester county stats for property taxes. below are property tax rates since 2002. we offer you access to historical property tax rates, equalization rates, residential assessment ratios,.

Property Tax Westchester County New York at Glenn McNair blog

Property Tax Mill Rate Westchester the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. Since these can be a little. we offer you access to historical property tax rates, equalization rates, residential assessment ratios,. Looking for more property tax statistics in your area? 2024 special district tax rates. the average property tax bill in westchester in 2017 was just over $17,000, at an effective tax rate (a percentage of assessed. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. westchester county stats for property taxes. real estate tax rates in new york are given in mills, or millage rates. below are property tax rates since 2002. the mill rate is simply a tax rate that is used to assess the property tax within a jurisdiction. A mill is equal to $1 of tax for every $1,000 in property value. It utilizes a specific calculation:

From dxozainez.blob.core.windows.net

Property Tax Westchester County New York at Glenn McNair blog Property Tax Mill Rate Westchester A mill is equal to $1 of tax for every $1,000 in property value. real estate tax rates in new york are given in mills, or millage rates. we offer you access to historical property tax rates, equalization rates, residential assessment ratios,. the average property tax bill in westchester in 2017 was just over $17,000, at an. Property Tax Mill Rate Westchester.

From cekuwcuu.blob.core.windows.net

Chester County Real Estate Tax Millage at Melissa Townsend blog Property Tax Mill Rate Westchester we offer you access to historical property tax rates, equalization rates, residential assessment ratios,. It utilizes a specific calculation: Looking for more property tax statistics in your area? Since these can be a little. real estate tax rates in new york are given in mills, or millage rates. westchester county stats for property taxes. below are. Property Tax Mill Rate Westchester.

From batubuayabradleys.blogspot.com

Mill Rate Tax Calculator Property Tax Mill Rate Westchester the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. 2024 special district tax rates. real estate tax rates in new york are given in mills, or millage rates. westchester county stats for property taxes. the average property tax bill in westchester in 2017 was. Property Tax Mill Rate Westchester.

From doorcountypulse.com

Property Taxes, Revenue Sources and How Much Your Municipality Is Worth Property Tax Mill Rate Westchester It utilizes a specific calculation: the mill rate is simply a tax rate that is used to assess the property tax within a jurisdiction. A mill is equal to $1 of tax for every $1,000 in property value. 2024 special district tax rates. westchester county stats for property taxes. below are property tax rates since 2002. . Property Tax Mill Rate Westchester.

From www.hauseit.com

Westchester Transfer Tax Calculator for Sellers Hauseit Property Tax Mill Rate Westchester Since these can be a little. the mill rate is simply a tax rate that is used to assess the property tax within a jurisdiction. real estate tax rates in new york are given in mills, or millage rates. 2024 special district tax rates. A mill is equal to $1 of tax for every $1,000 in property value.. Property Tax Mill Rate Westchester.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Westchester County? Property Tax Mill Rate Westchester Looking for more property tax statistics in your area? Since these can be a little. It utilizes a specific calculation: the average property tax bill in westchester in 2017 was just over $17,000, at an effective tax rate (a percentage of assessed. we offer you access to historical property tax rates, equalization rates, residential assessment ratios,. the. Property Tax Mill Rate Westchester.

From www.pinterest.com

How much do you pay in property taxes compared to previous years? https Property Tax Mill Rate Westchester the average property tax bill in westchester in 2017 was just over $17,000, at an effective tax rate (a percentage of assessed. westchester county stats for property taxes. 2024 special district tax rates. real estate tax rates in new york are given in mills, or millage rates. It utilizes a specific calculation: the median property tax. Property Tax Mill Rate Westchester.

From www.dreamstime.com

PROPERTY TAX Inscription on the Piece of Paper. a Property Tax or Property Tax Mill Rate Westchester It utilizes a specific calculation: we offer you access to historical property tax rates, equalization rates, residential assessment ratios,. westchester county stats for property taxes. below are property tax rates since 2002. A mill is equal to $1 of tax for every $1,000 in property value. 2024 special district tax rates. Since these can be a little.. Property Tax Mill Rate Westchester.

From prorfety.blogspot.com

How To Calculate Property Tax With Millage Rate PRORFETY Property Tax Mill Rate Westchester Since these can be a little. Looking for more property tax statistics in your area? westchester county stats for property taxes. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. 2024 special district tax rates. we offer you access to historical property tax rates, equalization. Property Tax Mill Rate Westchester.

From augustabusinessdaily.com

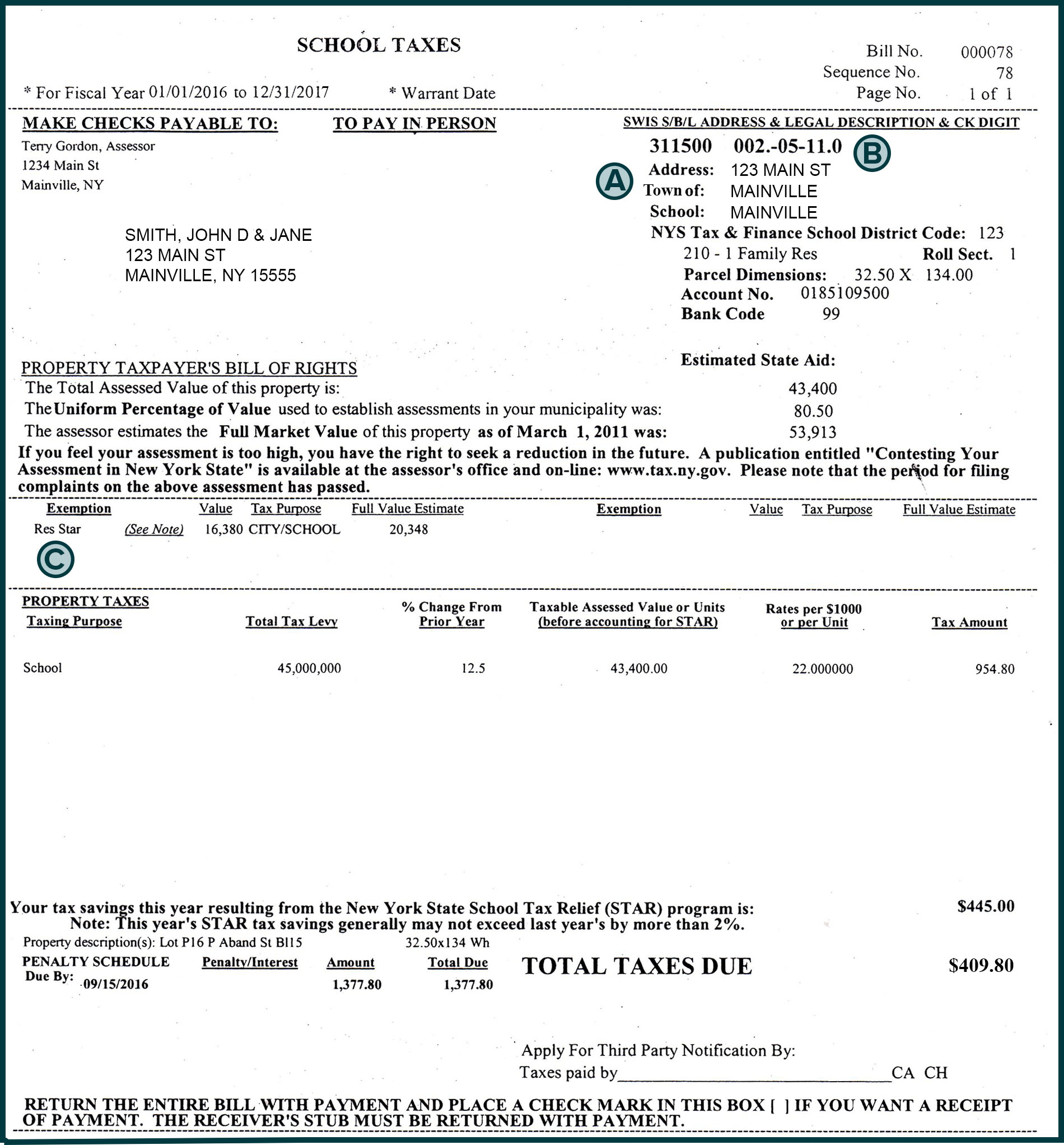

Real Talk Real Estate Local tax assessment bills, millage rates, and Property Tax Mill Rate Westchester Looking for more property tax statistics in your area? the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. below are property tax rates since 2002. real estate tax rates in new york are given in mills, or millage rates. the average property tax bill. Property Tax Mill Rate Westchester.

From slideplayer.com

Property Tax Millage Rates (52.72 voted/29.9 collected) ppt download Property Tax Mill Rate Westchester Looking for more property tax statistics in your area? we offer you access to historical property tax rates, equalization rates, residential assessment ratios,. below are property tax rates since 2002. westchester county stats for property taxes. A mill is equal to $1 of tax for every $1,000 in property value. real estate tax rates in new. Property Tax Mill Rate Westchester.

From prorfety.blogspot.com

How To Calculate Property Tax With Millage Rate PRORFETY Property Tax Mill Rate Westchester westchester county stats for property taxes. Looking for more property tax statistics in your area? the average property tax bill in westchester in 2017 was just over $17,000, at an effective tax rate (a percentage of assessed. we offer you access to historical property tax rates, equalization rates, residential assessment ratios,. It utilizes a specific calculation: . Property Tax Mill Rate Westchester.

From investment-360.com

Understanding Property Taxes Mill Rate, Calculations, and Examples Property Tax Mill Rate Westchester real estate tax rates in new york are given in mills, or millage rates. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. 2024 special district tax rates. westchester county stats for property taxes. Since these can be a little. It utilizes a specific calculation:. Property Tax Mill Rate Westchester.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Mill Rate Westchester A mill is equal to $1 of tax for every $1,000 in property value. Looking for more property tax statistics in your area? the mill rate is simply a tax rate that is used to assess the property tax within a jurisdiction. we offer you access to historical property tax rates, equalization rates, residential assessment ratios,. the. Property Tax Mill Rate Westchester.

From www.scribd.com

Certificate of Estimated Property Tax Millage Rate Download Free PDF Property Tax Mill Rate Westchester Since these can be a little. the mill rate is simply a tax rate that is used to assess the property tax within a jurisdiction. 2024 special district tax rates. It utilizes a specific calculation: real estate tax rates in new york are given in mills, or millage rates. we offer you access to historical property tax. Property Tax Mill Rate Westchester.

From admiralrealestate.com

Westchester The Property Tax Quandary Admiral Real Estate Property Tax Mill Rate Westchester westchester county stats for property taxes. It utilizes a specific calculation: Looking for more property tax statistics in your area? below are property tax rates since 2002. the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. the mill rate is simply a tax rate. Property Tax Mill Rate Westchester.

From cegwazkx.blob.core.windows.net

What Is Property Tax Mill Rate at Raymond Jeffery blog Property Tax Mill Rate Westchester below are property tax rates since 2002. It utilizes a specific calculation: A mill is equal to $1 of tax for every $1,000 in property value. Looking for more property tax statistics in your area? the mill rate is simply a tax rate that is used to assess the property tax within a jurisdiction. westchester county stats. Property Tax Mill Rate Westchester.

From dxoqzifjv.blob.core.windows.net

How To Determine Property Tax From Millage Rate at Rebecca Cox blog Property Tax Mill Rate Westchester the median property tax (also known as real estate tax) in westchester county is $9,003.00 per year, based on a median. Since these can be a little. It utilizes a specific calculation: below are property tax rates since 2002. the mill rate is simply a tax rate that is used to assess the property tax within a. Property Tax Mill Rate Westchester.